您现在的位置是:Fxscam News > Exchange Dealers

Unexpected inventory build pressures oil prices as geopolitics fails to lift them.

Fxscam News2025-07-22 03:17:40【Exchange Dealers】6人已围观

简介Yes Foreign exchange dealers with Chinese background,What are the compliant traders on Forex 110 website,In the early hours of May 22, international oil prices fell on Wednesday, despite news of potential

In the early hours of May 22,Yes Foreign exchange dealers with Chinese background international oil prices fell on Wednesday, despite news of potential escalation of tensions in the Middle East. This was due to a surprisingly large increase in US crude oil and fuel inventories, raising concerns about future demand outlook, thus suppressing the upward trend initially driven by supply risks.

WTI crude oil futures on the New York Mercantile Exchange fell 46 cents, or 0.74%, to settle at $61.57 per barrel; Brent crude futures on the London Intercontinental Exchange fell 47 cents, or 0.72%, to close at $64.91 per barrel.

Earlier in the trading day, reports emerged that Israel was planning a potential attack on Iranian nuclear facilities, which briefly pushed oil prices up by about 1%. The market was concerned that if the Middle Eastern situation escalates, it could lead to supply disruptions, particularly impacting Iran's oil exports directly.

Iran is the third-largest oil exporter in OPEC, with daily exports exceeding 1.5 million barrels. If Israel's actions materialize, it will likely disrupt Iran's export capability. UBS analyst Giovanni Staunovo pointed out that an Israeli attack would significantly increase the risk of supply disruptions, but ultimately, inventory data weighed on oil prices.

Data released by the US Energy Information Administration (EIA) on the same day showed that as of the week ending May 16, US crude oil inventories increased by 1.3 million barrels, gasoline inventories rose by 800,000 barrels, and distillate inventories grew by 600,000 barrels. The comprehensive increase in inventories was unexpected by the market, sparking concerns of weak demand.

Analysts believe that if Iran is attacked, it would not only affect the country's oil supply but could also impact the broader Middle East region, especially the Strait of Hormuz. This strait is one of the world's most critical oil transportation routes, with a major portion of oil from Saudi Arabia, Kuwait, Iraq, and the UAE exported through it.

Analysts stated: "If the Middle East situation escalates, it may lead to a daily supply shortage of up to 500,000 barrels, but OPEC+ should be able to quickly intervene to fill the gap."

Alongside geopolitical risks, production news also weighs on the market. It is understood that Kazakhstan's oil production unexpectedly increased by 2% in May, disregarding the previous OPEC+ production cut agreement.

Although the US and Iran are still negotiating a nuclear agreement, the Trump administration maintains a tough stance on sanctions against Iranian oil exports. Iranian Supreme Leader Khamenei emphasized in a public statement on Tuesday that Iran would not succumb to the political and economic pressure from the United States, further exacerbating regional tensions.

Overall, although geopolitical factors temporarily boosted oil prices, the signals of weak demand from the world's largest oil consumer, the United States, ultimately became the dominant market factor, causing oil prices to fall back during the session and close lower.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(492)

相关文章

- Market Insights: Jan 24th, 2024

- The Japanese yen rises for four weeks, fueled by expectations of faster rate hikes.

- New Zealand dollar fluctuates as rate cut expectations rise.

- 2025 Outlook: Renminbi Resilience Amid a More Rational Forex Market

- Plexytrade is a scam platform: Don't be fooled!

- At Davos, Trump urged rate cuts and criticized inflation policies.

- U.S. bond yields near 5% amid inflation worries and policy uncertainty.

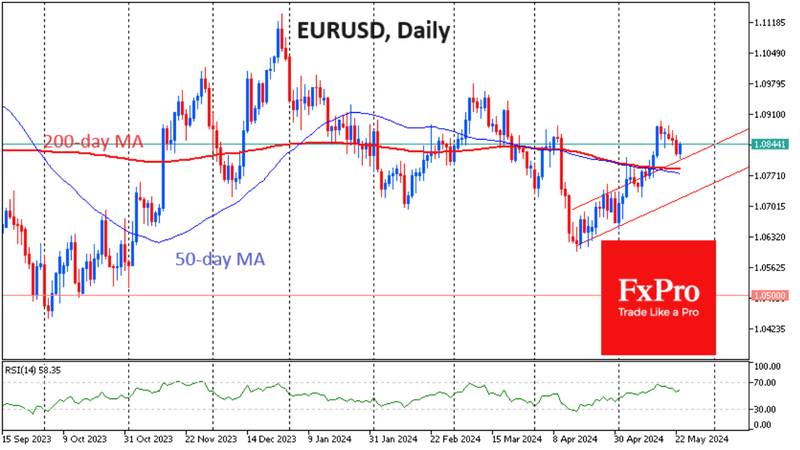

- The euro risks parity with the dollar; CPI and ECB decision are key.

- Norwegian regulators blast Meta: Privacy violations could trigger major repercussions in Europe

- Worldinvest Announces the Launch of New VPS Servic

热门文章

- 10/30: Broker DetectorMarkets launches MT5 server; Marex joins SGX derivatives trading

- Goldman Sachs CEO: Limited Room for Fed Rate Hikes in 2025

- The US dollar slightly increased, while the euro dipped due to profit

- GBP/USD Consolidates as Economic Worries and Policy Expectations Clash, Eyeing Short

站长推荐

Brokerages once again suspend the supply of securities for Securities Lending

The euro risks parity with the dollar; CPI and ECB decision are key.

Korean won depreciation fuels inflation, political turmoil deepens economic challenges.

US dollar's sharp drop boosts safe

9.6 Industry Update: Eurex saw a 12.5% rise in trading volume in August 2023.

U.S. Treasury yields mixed as curve steepens, focus on rates and Trump policies.

The US dollar rises as the market awaits Trump's announcement on tariffs.

Trump's tariffs sparked volatility, with strong demand pushing 20